News

Chief Felix Chidi Idiga (Chairman/CEO of JAFAC Group) Acquires a New Private Jet.

Felix Chidi Idiga is a Nigerian Business Mogul/Entrepreneur/ Administrator and Politician, Born June 30, 1963, in Amifeke, Orlu, Imo State.

He is the Chairman/CEO of JAFAC Group of Companies, Felix Idiga attended St. Mary’s Primary School, Amaifeke, Orlu, from 1972 to 1977 and later proceeded to secondary school.

He was unable to complete secondary school in one stretch due to his natural quest for business and entrepreneurship.

Profile Of Chief Dr. Felix Chidi Idiga

Real name Felix Chidi Idiga

Date of birth June 30, 1963

Nationality Nigerian

Source of Wealth Businessman

Net worth $879 million

Wife Chinyere Ada Idiga

Click on the link below to watch video of the Jet and it’s components and features

News

Man in shock after lady he lodged with in a hotel in Abuja flees with his car and other valuables

A Nigerian man is currently in shock after a young lady identified as Precious Chinyere , whom he took to a hotel in the Asokoro area in the FCT for a romantic getaway allegedly fled with his car and other personal belongings on Thursday, February 5,

The distraught man and Precious had visited the hotel and opted for a short time stay. Things took a different in the evening when the man noticed Precious had left the hotel room without notifying him and took along with her some of his personal belongings including phones and laptop and also his car.

The victim immediately reported the incident to the police.

When contacted, the spokesperson of the FCT police command, SP Josephine Adeh, told LIB that the matter is currently being investigated and that efforts are being made to apprehend the suspect.

News

US Reacts As De@th Toll In Kwara Terror Attacks Hits 200

The United States Mission in Nigeria has condemned the k!lling of more than 200 civilians in recent attacks on communities in Kwara State.

Recall that terrorists launched de@dly attacks on Woro and Nuku communities in Kaiama Local Government Area of the state on Tuesday night, k!lling unsuspecting citizens.

It was gathered that the gunmen invaded the villages, opened fire on residents and burned homes.

According to reports, the de@th toll from the unfortunate incident hit 200 on Thursday night.

Reacting, the US Mission Nigeria condemned the k!lling via a post on its official X handle.

The post reads, “The United States condemns the horrific attack in Kwara state in Nigeria, which claimed the lives of more than 160 people, with the de@th toll still unconfirmed and many still unaccounted for.

“We express our deepest condolences to the families of those affected by this senseless violence.

“We welcome President Tinubu’s order to deploy security forces to protect villages in the area and his directive to federal and state officials to provide aid to the community and bring the perpetrators of this atrocity to justice.”

News

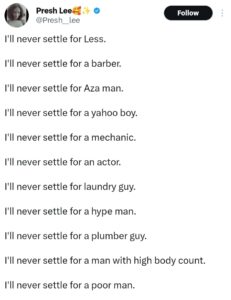

“I’ll never settle for a barber, yahoo boy or a poor man” — nail tech’s list of men she says she can’t marry sparks reactions online

A Nigerian nail technician has set social media talking after openly listing the kind of men she says she can never settle for.

In a now-viral post, she stated clearly that she refuses to “settle for less” and went on to mention professions and traits she considers a no-go area.

According to her, she can never settle for a barber, an aza man, a yahoo boy, a mechanic, an actor, a laundry man, a hype man, or a plumber. She also added that she wouldn’t marry a man with a high body count or a poor man.

-

Business1 year ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

-

Trending1 year ago

Trending1 year agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

-

Politics1 year ago

Politics1 year agoMexico’s new president causes concern just weeks before the US elections

-

Politics1 year ago

Politics1 year agoPutin invites 20 world leaders

-

Politics1 year ago

Politics1 year agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

-

Entertainment1 year ago

Bobrisky falls ill in police custody, rushed to hospital

-

Entertainment1 year ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

-

Education1 year ago

GOVERNOR FUBARA APPOINTS COUNCIL MEMBERS FOR KEN SARO-WIWA POLYTECHNIC BORI