Business

Stop Interest Hiking, Experts Tell CBN As Apex Bank Raises Rate Again

By Chris UGWU, Kasarahchi ANIAGOLU Nov 27 2024

Some financial experts have said that the CBN’s 25 basis points rate hike signals a potential pause in interest rate increases starting next year, emphasizing the need for relief for small businesses facing high financing costs.

The Central Bank of Nigeria (CBN) had raised its interest rate by 25 basis points, increasing it from 27.25 per cent to 27.50 per cent, in response to the country’s rising inflation.

This decision was announced by CBN Governor Mr. Yemi Cardoso, who also chairs the Monetary Policy Committee (MPC), following their meeting in Abuja.

The MPC unanimously agreed to the hike as part of ongoing efforts to address inflationary pressures in the economy.

The analysts in an exclusive interview with THE WHISTLER noted that despite the CBN’s tightening measures, inflation remains high, with benefits mainly seen in exchange rate stability due to foreign portfolio inflows.

They agreed that the rate hike was expected due to rising inflation, warning that it will increase business financing costs, which could be passed to consumers and further strain household budgets.

Reacting to the development, Nigeria’s first Professor of Capital Market, Uche Uwaleke indicated that the move might signal an imminent pause in the CBN’s aggressive monetary tightening cycle.

Uwaleke noted that the marginal increase aligns with analysts’ expectations, suggesting a potential shift in the CBN’s strategy.

“The marginal rate increase is a signal that the CBN may completely pause or apply the brake on interest rate hikes starting from the first quarter of next year,” he explained.

The professor emphasized the necessity of a pause, citing the rising cost of funds and its adverse impact on credit access, particularly for small businesses. “This needs to happen so that small businesses can breathe,” he remarked.

Despite the CBN’s sustained tightening measures, headline inflation remains stubbornly high, reversing recent gains and rising further.

Uwaleke observed that the benefits of the rate hikes have been most apparent in the foreign exchange market, where increased foreign portfolio inflows have contributed to exchange rate stability in the official window.

However, the broader economic picture remains concerning. The Q3 2024 GDP report released by the National Bureau of Statistics (NBS) showed weak performance in the agriculture and manufacturing sectors, a development Uwaleke attributed to rising interest and exchange rates.

He stressed the need for coordinated efforts between monetary and fiscal authorities to navigate the country’s macroeconomic challenges effectively.

“The current macro-economic challenges make it imperative for a proper synergy between monetary and fiscal policies,” he advised.

Managing Director of Arthur Steven Asset Management Limited and former President of the Chartered Institute of Stockbrokers (CIS), Mr. Olatunde Amolegbe also shared his views on the Central Bank of Nigeria’s (CBN) decision to raise the Monetary Policy Rate (MPR) by 25 basis points, moving it from 27.25 per cent to 27.50 per cent.

Amolegbe noted that the rate hike was widely anticipated, particularly given the National Bureau of Statistics (NBS) report showing inflation had increased by over 100 basis points in the previous month.

“The truth is that this was somewhat expected,” Amolegbe stated, acknowledging that many analysts had predicted this adjustment, with some even anticipating a higher increase due to ongoing price instability across various sectors of the economy.

He further pointed out that the government’s fiscal and structural measures, aimed at curbing inflation, have yet to yield immediate results.

“These measures typically take time to have the desired impact,” he said, adding that as a result, monetary policy has remained the primary tool available to the CBN in its efforts to stabilize the economy.

“This leaves us with monetary policy as the only effective tool to prevent the economy from spiraling out of control,” he explained.

However, Amolegbe also warned of the potential negative consequences of the rate hike on businesses and consumers.

“The likely impact of this move will be a further increase in financing costs for businesses,” he stated.

These higher costs are expected to be passed on to consumers, potentially raising prices on goods and services and putting additional strain on household budgets.

Amolegbe concluded by emphasizing the delicate balance the CBN faces in managing inflation and ensuring that the economy does not overheat, while acknowledging the challenges that persist in the broader economic landscape.

Managing Director of Highcap Securities Limited, Mr. David Adonri also weighed in on the Central Bank of Nigeria’s continued use of interest rate hikes as a tool to manage inflation, noting that while effective in the short term, it remains insufficient in addressing the underlying economic issues.

In an exclusive interview, Adonri explained that interest rate adjustments are a critical component of monetary policy designed to curb inflation until more sustainable fiscal measures can be implemented to address the structural causes of economic imbalance.

“Interest rates are a potent tool for managing inflation in the short term,” Adonri stated.

“However, their effectiveness is often limited when coupled with expansionary fiscal policies,” he added.

He further emphasized that the ongoing fiscal expansion, alongside factors such as insecurity and currency depreciation, continues to fuel inflation.

These persistent challenges leave the CBN’s Monetary Policy Committee (MPC) with few options but to maintain its contractionary monetary stance.

“As long as fiscal policies remain expansionary and the factors driving inflation persist, the MPC will have no choice but to continue raising interest rates,” he explained.

Adonri also cautioned that allowing inflation to spiral out of control would have devastating consequences for both consumers and producers. “The impact of unchecked inflation would be far more harmful than the effects of higher interest rates,” he warned, underlining the importance of the MPC’s approach in preventing further economic instability.

Despite the negative effects on certain sectors of the economy, Adonri acknowledged that the interest rate hikes provide a silver lining for investors in debt instruments.

“The bonanza for investors in debt assets will continue as the rates rise,” he noted, as higher interest rates typically make fixed-income investments more attractive.

In conclusion, while the CBN’s monetary policy actions are necessary to address the current inflationary pressures, Adonri stressed the need for a coordinated effort between monetary and fiscal policies to tackle the structural issues contributing to inflation and ensure sustainable economic growth in the long term.

Meanwhile, Cardoso called for critical synergy between the monetary and fiscal sectors of the economy to achieve price stability and curtail inflationary pressures on food and other commodities.

According to Cardoso, food prices remain a key driver of inflation, compounded by rising energy costs that affect production factors.

“The recent increase in the price of Premium Motor Spirit (PMS) has also impacted the cost of production and distribution of food items and manufactured goods.

“The Committee was optimistic that the full deregulation of the downstream sub-sector of the petroleum industry would eliminate scarcity and stabilize price levels in the short to medium term.

“Members, thus, reiterated the need to deepen collaboration between the monetary and fiscal authorities to ensure the achievement of our synchronized objectives of price stability and sustainable growth.”

Cardoso highlighted members’ concerns over persistent exchange rate pressures, driven by continued high demand in the market.

Cardoso expressed satisfaction with the resilience and stability of the banking sector despite significant external and internal challenges.

He outlined key financial soundness indicators, stating that the “Capital Adequacy Ratio (CAR), Non-Performing Loan (NPL) ratio, and Liquidity Ratio (LR), among others, remain strong.”

Business

Soludo takes over Onitsha main market as IPOB declares compulsory sit-at-home

The Governor of Anambra State, Prof Chukwuma Soludo has announced that his government will take over the running of Onitsha Main Market.

The governor had last Monday visited the market and also announced a one week closure over the continued adherence to sit at home protest by traders in the market.

The closure had generated a lot of tension, leading to protests by the traders, while the governor stuck to his gone, insisting that the market will remain closed for one week. He also held a meeting with the leaders of the market yesterday, where he presented them with two options.

Though it was a closed door meeting, which held at the Light House, Awka, a source in the meeting told THISDAY that the traders chose to open their shops on Monday, against an earlier option of demolishing and remodelling the market.

The source said: “The governor gave them two options. The first included; they will resume full trading activities on Mondays, mark attendance as required, while he regenerate and reorganise the market, demolish all illegal structures and plazas and create proper spaces and car parks. The second includes; To continue with Sit-at-Home on Mondays and risk the demolition of the market and use two-years for its reconstruction to restore it to its original master plan.

“The governor told them that restoring parking facilities in Main Market is an emergency, and any illegal structure erected at the park would be demolished soonest.”

It was gathered that the traders choose the first option, which will involve them opening on Monday, and giving the governor the go ahead to remove illegal structures to make way for wider roads in the market and restoring its packing space.

During the meeting, the governor told the traders that a committee will be set up to rectify all occupants of shops in the market, and that this will commence work soon, insisting that the government needs to know those who are trading in its market.

The governor was also said to have rejected a plea for the market to be opened on Saturday, insisting it can only be opened on Monday, when their compliance will again be re-accessed.

“The traders agreed to the terms, and will on Monday reopen the market to recommence business,” the source said.

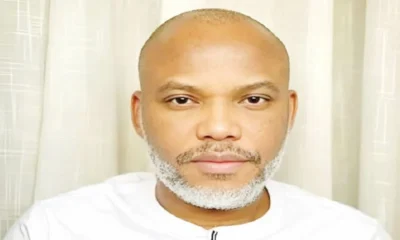

Meanwhile, secessionist group, Indigenous People of Biafra (IPOB) has declared what it called Biafra-wide solidarity lockdown which is to hold on Monday in solidarity with Onitsha traders and to demand for Mazi Nnamdi Kanu’s immediate release.

A press release by the group’s publicity secretary, Mr Emma Powerful said the total shutdown across Biafraland is a direct, peaceful, and unified response to the shutting down of Onitsha Main Market for one week by Soludo.

The release said: “We remind Governor Soludo and his Abuja sponsors that the Monday sit-at-home originated as a peaceful protest demanding the unconditional release of Mazi Nnamdi Kanu, the very cause that has galvanized global attention to Biafra’s quest for self-determination.

“Attempts to twist this into “economic sabotage” or “criminality” will fail. The markets thrived during Christmas Mondays without incident, proving that voluntary compliance stems from genuine solidarity, not fear. Soludo’s escalation only exposes his desperation to provoke confrontation at a time when Biafra’s international profile is rising and diplomatic efforts are gaining traction.

“On Monday, February 2, 2026, we call on all Biafrans traders, transporters, banks, schools, civil servants, and every sector across Anambra, Abia, Imo, Enugu, Ebonyi, and beyond to observe this solidarity strike peacefully.

“Remain indoors, refrain from all commercial and public activities, and demonstrate to the world our disciplined resolve. This is not about disruption for its own sake; it is about standing with Onitsha traders who are being punished for demanding justice, and reaffirming that no governor can coerce free citizens into abandoning their rights or their solidarity.”

Business

BUA Chairman Is My Ex-Husband – Tinubu’s Minister Opens Up On Past Secret With Abdul Samad Rabiu

Nigeria’s Minister of Art, Culture and the Creative Economy, Hannatu Musawa has opened up about her former marriage to BUA Group chairman Abdul Samad Rabiu, describing it as a meaningful and life-shaping experience.

In a conversation on the MIC On Podcast with Channels Television journalist Seun Okinbaloye, Musawa reflected on her bond with Rabiu, saying their connection has remained strong despite their separation.

She explained that their relationship has evolved into one grounded in family ties, mutual respect, and continued support.

Musawa shared that although they are no longer married, they remain close and involved in each other’s lives.

She also pointed out the lasting connection between their families, noting that her daughter, Khadija, was named after Rabiu’s grandmother, showing the enduring link between them.

The minister described her time with Rabiu as one of the most memorable periods of her life.

She stated that there is no bitterness between them and that she will continue to support him in his endeavors, maintaining respect and care for their shared history.

She said: “We love each other because you love your family, obviously. But Samad is my brother. He’s my family. That’s what he is. And I’m his sister and his family, too. The marriage of the greatest experiences I’ve ever had.

“He is my ex-husband, but we are still family. We juggle coming from a background where, once you’re joined together, you continue to participate in each other’s lives. And so, we were married, and now we are just family.

“My daughter Khadija was named after Samad’s grandmother.

“We continue to share a deep respect and a love, and more than anything, support for each other. I’ll continue to be his greatest cheerleader.”

Abdul Samad Rabiu leads BUA Group, a Nigerian conglomerate with investments in cement, sugar, and other industries, and is regarded as one of the country’s leading business figures.

Business

LIRS reiterates January 31st deadline for employers’ Annual Tax returns filing

The Lagos State Internal Revenue Service (LIRS) has reiterated the statutory deadline of 31st January 2026 for all employers of labour in Lagos State to fulfil their statutory obligation to file their annual tax returns for the 2025 financial year.

In a statement issued on Thursday, January 19, the Executive Chairman of LIRS, Dr Ayodele Subair, reminded employers that the obligation to file annual returns is in accordance with the provisions of the Nigeria Tax Administration Act 2025 (NTAA).

Dr Subair explained that employers are required to file detailed returns on emoluments and compensation paid to their employees, as well as payments made to their service providers, vendors and consultants, and to ensure that all applicable taxes due for the year 2025 are fully remitted. He emphasised that filing of annual returns is a mandatory legal obligation, and warned that failure to comply will result in statutory sanctions, including administrative penalties, as prescribed under the new tax law.

According to Section 14 of the Nigeria Tax Administration Act 2025 (NTAA), employers are required to file detailed annual returns of all emoluments paid to employees, including taxes deducted and remitted to relevant tax authorities. Such returns must be filed and submitted not later than January 31 each year.

Dr Subair stated

“Employers must prioritise the timely filing of their annual income tax returns. Compliance should be part of our everyday business practice. Early and accurate filing not only ensures adherence to the law as required by the Nigerian Constitution, but also supports effective revenue tracking, which is important to Lagos State’s fiscal planning and sustainability.”

He further noted that in Lagos State, electronic filing via the LIRS eTax platform remains the only approved and acceptable mode of filing, as manual submissions have been completely phased out. This measure, he said, is aimed at simplifying and standardising tax administration processes in the State.

Read more in comments section

-

Business1 year ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

-

Trending1 year ago

Trending1 year agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

-

Politics1 year ago

Politics1 year agoMexico’s new president causes concern just weeks before the US elections

-

Politics1 year ago

Politics1 year agoPutin invites 20 world leaders

-

Politics1 year ago

Politics1 year agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

-

Entertainment1 year ago

Bobrisky falls ill in police custody, rushed to hospital

-

Entertainment1 year ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

-

Education1 year ago

GOVERNOR FUBARA APPOINTS COUNCIL MEMBERS FOR KEN SARO-WIWA POLYTECHNIC BORI