Business

PETROLEUM MINISTRY AND THREE AGENCIES UNDER ITS SUPERVISION PARTICIPATE IN IMF ARTICLE IV CONSULTATION

The Ministry of Petroleum Resources (MPR), alongside three agencies under its supervision—the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), and the Nigerian National Petroleum Company Limited (NNPCL), recently participated in the ongoing International Monetary Fund (IMF) Article IV Consultation in Nigeria.

The IMF team was in the country at the invitation of the Federal Government to engage selected government institutions and gather insights on developments across various sectors of the economy.

Speaking during the meeting held in Abuja, the Chairman of the session and Permanent Secretary of the Ministry of Petroleum Resources, Ambassador Nicholas Agbo Ella, expressed appreciation to the IMF team for their continued efforts and commitment to the growth and development of the Nigerian economy, particularly the oil and gas sector.

Ambassador Ella encouraged representatives of NUPRC, NMDPRA, and NNPCL to engage fully in the consultation, stressing the importance of collaboration and innovation in achieving tangible economic outcomes.

During the meeting, the three agencies delivered comprehensive presentations, offering valuable insights into Nigeria’s crude oil production trends and projections. It was highlighted that despite prevailing challenges, the country achieved an average of 88% of its projected crude oil volume, attributed to reduced losses and increased output. Efforts are also underway to revive underperforming assets and improve output from flow stations to terminals.

Regarding gas production, the presentations underscored existing infrastructure developments and ongoing investments aimed at achieving production and distribution targets.

A significant part of the consultation examined the recent fuel subsidy removal by President Bola Ahmed Tinubu and the strategies being employed to ensure its long-term sustainability. Discussions reflected a shared commitment to market-driven reforms and enhanced fiscal responsibility within the petroleum sector.

Participants at the meeting agreed that strong inter-agency collaboration, along with support from development partners and financial institutions, is essential to stabilize global oil markets and strengthen Nigeria’s energy security.

The meeting was attended by Directors, Heads of Units, and staff from the Ministry of Petroleum Resources, representatives from the Federal Ministry of Finance, and IMF consultants.

This successful engagement reaffirmed Nigeria’s strategic commitment to transparency, sustainable growth, and international cooperation in the petroleum industry.

Business

Soludo takes over Onitsha main market as IPOB declares compulsory sit-at-home

The Governor of Anambra State, Prof Chukwuma Soludo has announced that his government will take over the running of Onitsha Main Market.

The governor had last Monday visited the market and also announced a one week closure over the continued adherence to sit at home protest by traders in the market.

The closure had generated a lot of tension, leading to protests by the traders, while the governor stuck to his gone, insisting that the market will remain closed for one week. He also held a meeting with the leaders of the market yesterday, where he presented them with two options.

Though it was a closed door meeting, which held at the Light House, Awka, a source in the meeting told THISDAY that the traders chose to open their shops on Monday, against an earlier option of demolishing and remodelling the market.

The source said: “The governor gave them two options. The first included; they will resume full trading activities on Mondays, mark attendance as required, while he regenerate and reorganise the market, demolish all illegal structures and plazas and create proper spaces and car parks. The second includes; To continue with Sit-at-Home on Mondays and risk the demolition of the market and use two-years for its reconstruction to restore it to its original master plan.

“The governor told them that restoring parking facilities in Main Market is an emergency, and any illegal structure erected at the park would be demolished soonest.”

It was gathered that the traders choose the first option, which will involve them opening on Monday, and giving the governor the go ahead to remove illegal structures to make way for wider roads in the market and restoring its packing space.

During the meeting, the governor told the traders that a committee will be set up to rectify all occupants of shops in the market, and that this will commence work soon, insisting that the government needs to know those who are trading in its market.

The governor was also said to have rejected a plea for the market to be opened on Saturday, insisting it can only be opened on Monday, when their compliance will again be re-accessed.

“The traders agreed to the terms, and will on Monday reopen the market to recommence business,” the source said.

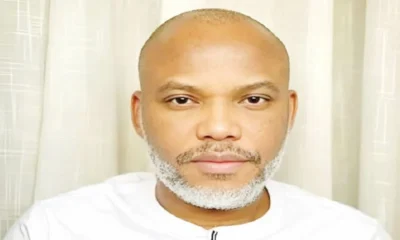

Meanwhile, secessionist group, Indigenous People of Biafra (IPOB) has declared what it called Biafra-wide solidarity lockdown which is to hold on Monday in solidarity with Onitsha traders and to demand for Mazi Nnamdi Kanu’s immediate release.

A press release by the group’s publicity secretary, Mr Emma Powerful said the total shutdown across Biafraland is a direct, peaceful, and unified response to the shutting down of Onitsha Main Market for one week by Soludo.

The release said: “We remind Governor Soludo and his Abuja sponsors that the Monday sit-at-home originated as a peaceful protest demanding the unconditional release of Mazi Nnamdi Kanu, the very cause that has galvanized global attention to Biafra’s quest for self-determination.

“Attempts to twist this into “economic sabotage” or “criminality” will fail. The markets thrived during Christmas Mondays without incident, proving that voluntary compliance stems from genuine solidarity, not fear. Soludo’s escalation only exposes his desperation to provoke confrontation at a time when Biafra’s international profile is rising and diplomatic efforts are gaining traction.

“On Monday, February 2, 2026, we call on all Biafrans traders, transporters, banks, schools, civil servants, and every sector across Anambra, Abia, Imo, Enugu, Ebonyi, and beyond to observe this solidarity strike peacefully.

“Remain indoors, refrain from all commercial and public activities, and demonstrate to the world our disciplined resolve. This is not about disruption for its own sake; it is about standing with Onitsha traders who are being punished for demanding justice, and reaffirming that no governor can coerce free citizens into abandoning their rights or their solidarity.”

Business

BUA Chairman Is My Ex-Husband – Tinubu’s Minister Opens Up On Past Secret With Abdul Samad Rabiu

Nigeria’s Minister of Art, Culture and the Creative Economy, Hannatu Musawa has opened up about her former marriage to BUA Group chairman Abdul Samad Rabiu, describing it as a meaningful and life-shaping experience.

In a conversation on the MIC On Podcast with Channels Television journalist Seun Okinbaloye, Musawa reflected on her bond with Rabiu, saying their connection has remained strong despite their separation.

She explained that their relationship has evolved into one grounded in family ties, mutual respect, and continued support.

Musawa shared that although they are no longer married, they remain close and involved in each other’s lives.

She also pointed out the lasting connection between their families, noting that her daughter, Khadija, was named after Rabiu’s grandmother, showing the enduring link between them.

The minister described her time with Rabiu as one of the most memorable periods of her life.

She stated that there is no bitterness between them and that she will continue to support him in his endeavors, maintaining respect and care for their shared history.

She said: “We love each other because you love your family, obviously. But Samad is my brother. He’s my family. That’s what he is. And I’m his sister and his family, too. The marriage of the greatest experiences I’ve ever had.

“He is my ex-husband, but we are still family. We juggle coming from a background where, once you’re joined together, you continue to participate in each other’s lives. And so, we were married, and now we are just family.

“My daughter Khadija was named after Samad’s grandmother.

“We continue to share a deep respect and a love, and more than anything, support for each other. I’ll continue to be his greatest cheerleader.”

Abdul Samad Rabiu leads BUA Group, a Nigerian conglomerate with investments in cement, sugar, and other industries, and is regarded as one of the country’s leading business figures.

Business

LIRS reiterates January 31st deadline for employers’ Annual Tax returns filing

The Lagos State Internal Revenue Service (LIRS) has reiterated the statutory deadline of 31st January 2026 for all employers of labour in Lagos State to fulfil their statutory obligation to file their annual tax returns for the 2025 financial year.

In a statement issued on Thursday, January 19, the Executive Chairman of LIRS, Dr Ayodele Subair, reminded employers that the obligation to file annual returns is in accordance with the provisions of the Nigeria Tax Administration Act 2025 (NTAA).

Dr Subair explained that employers are required to file detailed returns on emoluments and compensation paid to their employees, as well as payments made to their service providers, vendors and consultants, and to ensure that all applicable taxes due for the year 2025 are fully remitted. He emphasised that filing of annual returns is a mandatory legal obligation, and warned that failure to comply will result in statutory sanctions, including administrative penalties, as prescribed under the new tax law.

According to Section 14 of the Nigeria Tax Administration Act 2025 (NTAA), employers are required to file detailed annual returns of all emoluments paid to employees, including taxes deducted and remitted to relevant tax authorities. Such returns must be filed and submitted not later than January 31 each year.

Dr Subair stated

“Employers must prioritise the timely filing of their annual income tax returns. Compliance should be part of our everyday business practice. Early and accurate filing not only ensures adherence to the law as required by the Nigerian Constitution, but also supports effective revenue tracking, which is important to Lagos State’s fiscal planning and sustainability.”

He further noted that in Lagos State, electronic filing via the LIRS eTax platform remains the only approved and acceptable mode of filing, as manual submissions have been completely phased out. This measure, he said, is aimed at simplifying and standardising tax administration processes in the State.

Read more in comments section

-

Business1 year ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

-

Trending1 year ago

Trending1 year agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

-

Politics1 year ago

Politics1 year agoMexico’s new president causes concern just weeks before the US elections

-

Politics1 year ago

Politics1 year agoPutin invites 20 world leaders

-

Politics1 year ago

Politics1 year agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

-

Entertainment1 year ago

Bobrisky falls ill in police custody, rushed to hospital

-

Entertainment1 year ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

-

Education1 year ago

GOVERNOR FUBARA APPOINTS COUNCIL MEMBERS FOR KEN SARO-WIWA POLYTECHNIC BORI