News

Glitches: FG mulls harmonised regulatory framework to boost financial inclusion

Amid glitches many Nigerians experience in online financial transactions, the Federal Government in conjunction with key stakeholders on Monday, engaged in a brainstorming session to birth harmonised regulatory framework.

Stakeholders drawn from the Central Bank of Nigeria, the Nigeria Deposit Insurance Corporation, NDIC, the Chartered Institute of Bankers of Nigeria, CIBN, Lagos Business School, the Nigeria Financial Intelligence Unit, NFIU, the Nigeria Police Force, among others, all gathered at the Presidential Villa, Abuja to explore ways that could be beneficial in addressing glitches that has become a regular trend in the financial services sector.

They observed that many Nigerians are dissatisfied over government’s poor financial inclusion policies, noting that an harmonised system of addressing complaints may salvage the sector from losing public trust.

The meeting called at the instance of Nurudeen Zauro, Special Adviser to the President, on Economic and Financial Inclusion, noted that the government had developed plans to ease transactions, payments, savings, credit and insurance, as well as help people manage risks, build wealth and invest in businesses.

Zauro stated that the government is poised to pursue legislation to address the issue of consumer trust, if necessary.

With Financial Inclusion, individuals and businesses are expected to have access to and use affordable financial products and services that meet their needs, which are delivered in a responsible and sustainable way.

Over the years, however, Nigerians had issue with trust.

Zauro charged the stakeholders to “ build public trust” in the management of financial inclusion, set clear declaration on where customers can make necessary complaints and work on the regulatory spectrum to address the challenges in the national inclusion issue.

According to him, “ The People must trust and have confidence in the system, as well as evolve mechanisms on how people can seek redress for infractions”

He recalled how President Bola Tinubu had in 2024, issued an order to strengthen partnership, collaboration, commitment amongst the stakeholders, as well as recognition of the importance of financial institutions in the Nigerian economy.

“So what brings about this national framework for consumer trust? We believe that for people to come and be financially included, they have to build confidence and trust in the system”

He recalled that there have been issues around cyber security, 419, trusts and even lack of knowledge in terms of capacity building.

“So because of that, there’s a need for us to ensure that all the instrumentality of government are on board, they are doing their work in order to restore the trust of the last man, the poor and vulnerable Nigerian. That is why we started with the workshop with the entire stakeholders.

He disclosed that the stakeholders forum was the direct result of over one-year brainstorming sessions which harmonized the national consumer trust framework.

“ So we know a lot of agencies that are doing good things, like the Central Bank, they are doing fantastic job. All the regulators are also doing good things.

He assured that the Presidency will keep engaging “stakeholders to see how they can we serve Nigerians better?

He also revealed that the Presidency already has a draft framework.

“That’s why both the private and public sector institutions are all heavily represented in this at the end of the day, it will be issued as a national framework for the country.

“As we move on, if the situation demands legislation, then that will be done. Mr. President is pretty much ready, is available, to do all that is needed to restore the confidence of Nigerians in the financial system,

“He will be able to say; yes,I believe we have, we have a trusted financial system”

Aisha Olatiwoon, Director of consumer protection and financial inclusion of the Central Bank of Nigeria, said the CBN has done much in ensuring that consumers of the banking sector gets remediation for breach of the financial inclusion plans of the federal government

“ I think, where the issue is, is that every complaint is pushed by the consumer to CBN.

“ Do, the reason I said the workshop today is apt, bringing together various regulators from different industries, even beyond the financial system.

The CBN blamed illiteracy on the side of the consumer for some of the challenges

“ Complaints that should come to CBN are basically complaints that remain unresolved by the financial institutions. And what do I mean by this? Customers are supposed to first escalate to their banks, and it is when the banks do not resolve within the regulatory specified period, or when the resolution is unsatisfactory to the consumer, then the consumer has a CBN backup, not withstanding all of this arrangement, the CBN has put in place a customer complaint management solution, which we are working to integrate with the industry dispute resolution system.

“That way, we have an overview and a very clear online visibility of companies and hold financial institutions responsible for not resolving within the set time”

News

Man in shock after lady he lodged with in a hotel in Abuja flees with his car and other valuables

A Nigerian man is currently in shock after a young lady identified as Precious Chinyere , whom he took to a hotel in the Asokoro area in the FCT for a romantic getaway allegedly fled with his car and other personal belongings on Thursday, February 5,

The distraught man and Precious had visited the hotel and opted for a short time stay. Things took a different in the evening when the man noticed Precious had left the hotel room without notifying him and took along with her some of his personal belongings including phones and laptop and also his car.

The victim immediately reported the incident to the police.

When contacted, the spokesperson of the FCT police command, SP Josephine Adeh, told LIB that the matter is currently being investigated and that efforts are being made to apprehend the suspect.

News

US Reacts As De@th Toll In Kwara Terror Attacks Hits 200

The United States Mission in Nigeria has condemned the k!lling of more than 200 civilians in recent attacks on communities in Kwara State.

Recall that terrorists launched de@dly attacks on Woro and Nuku communities in Kaiama Local Government Area of the state on Tuesday night, k!lling unsuspecting citizens.

It was gathered that the gunmen invaded the villages, opened fire on residents and burned homes.

According to reports, the de@th toll from the unfortunate incident hit 200 on Thursday night.

Reacting, the US Mission Nigeria condemned the k!lling via a post on its official X handle.

The post reads, “The United States condemns the horrific attack in Kwara state in Nigeria, which claimed the lives of more than 160 people, with the de@th toll still unconfirmed and many still unaccounted for.

“We express our deepest condolences to the families of those affected by this senseless violence.

“We welcome President Tinubu’s order to deploy security forces to protect villages in the area and his directive to federal and state officials to provide aid to the community and bring the perpetrators of this atrocity to justice.”

News

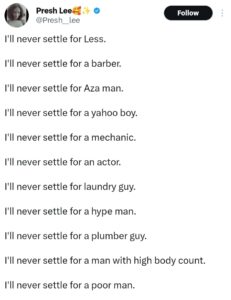

“I’ll never settle for a barber, yahoo boy or a poor man” — nail tech’s list of men she says she can’t marry sparks reactions online

A Nigerian nail technician has set social media talking after openly listing the kind of men she says she can never settle for.

In a now-viral post, she stated clearly that she refuses to “settle for less” and went on to mention professions and traits she considers a no-go area.

According to her, she can never settle for a barber, an aza man, a yahoo boy, a mechanic, an actor, a laundry man, a hype man, or a plumber. She also added that she wouldn’t marry a man with a high body count or a poor man.

-

Business1 year ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

-

Trending1 year ago

Trending1 year agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

-

Politics1 year ago

Politics1 year agoMexico’s new president causes concern just weeks before the US elections

-

Politics1 year ago

Politics1 year agoPutin invites 20 world leaders

-

Politics1 year ago

Politics1 year agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

-

Entertainment1 year ago

Bobrisky falls ill in police custody, rushed to hospital

-

Entertainment1 year ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

-

Education1 year ago

GOVERNOR FUBARA APPOINTS COUNCIL MEMBERS FOR KEN SARO-WIWA POLYTECHNIC BORI