News

The Chief of Staff to the President and former Speaker of the House of Representatives, Rt. Hon. Femi Gbajabiamila, has issued a “cease and desist” notice to Mr. Segun Olatunji, Editor of FirstNews, over allegedly “false and malicious defamatory” articles published by him or published off his interview with a news platform.

Gbajabiamila, in two letters dated May 3, 2024, by his solicitors Dr. Kemi Pinheiro SAN of Pinheiro LP, alerted the public to a “series of deliberate and coordinated malicious campaign of calumny against his person in various print, electronic and social media platforms.”

The Chief of Staff demanded a public apology from Olatunji and First News and a retraction of the allegedly false and malicious defamatory articles within seven days.

He also warned persons already hosting the said publications on their platforms or considering repeating the publications, of the legal implications of doing so, including civil and criminal proceedings under the cybercrime laws, among others.

The letter to Olatunji reads in part: “Our client’s attention has been drawn to the series of deliberate and coordinated malicious campaigns of calumny against his person in various print, electronic media and social media platforms arising from your article published on the 28th day of January 2024 (republished on the 6th of April, 2024) and interview you granted to the same online media platform Foundation for Investigative Journalism (FIJ) on the 4th day of April, 2024 in relation to your arrest and detention by the Defence Intelligence Agency (DIA).

“By the said article and interview you falsely and maliciously published of and concerning our Client defamatory words, wherein he was either expressly or by innuendo portrayed as a fraudulent, corrupt, dishonest, shady, unreliable and disloyal person who is unfit to hold the exalted office of Chief of Staff to the President of the Federal Republic of Nigeria.”

The letter demanded that Olatunji, “within 7 days of receipt of this letter, cause to be published in two national newspapers a full page unequivocal public retraction and apology in terms to be approved by our firm; and in this regard we expect you to revert to us within 3 days of receipt of this letter. You shall also be expected to circulate the retraction and apology on the same platforms wherein your article and interview were circulated.”

It warned that unless Olatunji responds satisfactorily, Pinheiro LP would seek exemplary and aggravated damages for libel, an injunction restraining him from further or similar publications, “an order for retraction of the defamatory words and a public apology in the terms and manners to be stipulated by us and published in at least two national dailies.”

Furthermore, the law firm advised the “unsuspecting members of the public who are already indulged or may be tempted to indulge in the dissemination of these obviously false and defamatory contents to immediately cease and desist from sharing, posting, forwarding, or disseminating the said contents or otherwise engage in cyberstalking of our client, premised on the defamatory words contained in the aforementioned interview and article….

“Unless this warning is heeded, our client will not hesitate to ensure that such perpetrators face the wrath of the law as provided for under Section 24 of the Cybercrime Prohibition and Prevention Act 2015, Sections 375 and 376 of the Criminal Code, and Sections 391, 392, 393, 394, and 395 of the Penal Code as well as a civil action in defamation.”

News

Police finally returned my stolen AI Ray-Ban sunglasses – Sowore

The Nigeria Police Force, NPF, has returned the Artificial intelligence, AI, Ray-Ban sun glasses back to activist politicians, Omoyele Sowore.

Sowore had alleged that the sun glass was stolen during a protest by retired police officers on July 21, 2025 at the Force headquarters.

The protest was organised to demand improved welfare and retirement benefits for Nigerian police officers.

During the peaceful protest, Sowore had claimed that the glass was stolen by one Aku Victor Chiemerie.

However, Sowore confirmed the return of the glasses in a post on X.

“Today, the Nigeria Police Force returned my stolen Ray-Ban Meta eyeglasses, stolen by the National Thief, Aku Victor Chiemerie, to me,” he wrote.

News

VP Shettima commissions library, other projects in Calabar

The Vice President, Kasshim Shettima has commissioned a state of the art library in Calabar recently refurbished by Gov Bassey Otu of Cross River State

He also commissioned the two newly acquired aircrafts by the government of Cross River State in the Margaret Ekpo international airport Calabar.

The two now increases the fleet of Cally Air airline to four.

The Vice President, who represented President Bola Tinubu, commended the State government for the feat.

Governor Bassey Otu expressed gratitude to the President for permitting Shettima to represent him at the auspicious occasion.

Otu said he is consolidating on the efforts and achievements of his predecessors, Donald Duke, Liyel Imoke and Ben Ayade who laid good foundation in three different important areas.

He said the Foundations have helped him to consolidate.

“Donald Duke came with tourism mentality, Senator Imoke focused on rural development while Ayade looked at industries.

“It was Ayade that initiated the aviation business. He actually purchased the first two aircrafts.

“I am now building on their efforts. With these two new aircrafts we’re poised to bolster the tourism potential of the state.

“We’ll add two more aircrafts before long to dominate the gulf of Guinea air route.”

News

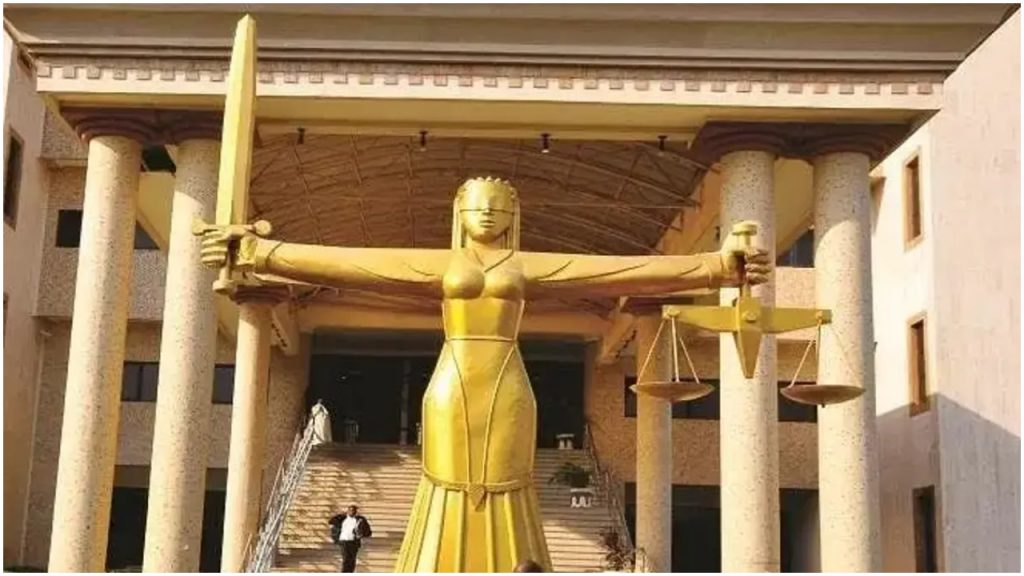

Nigerian Govt arraigns Al-Shabab terrorists over killing of 40 worshippers in Owo church

The Federal Government on Monday arraigned five men before a Federal High Court in Abuja over their alleged involvement in the June 5, 2022 attack at St. Francs Catholic Church, Owo, Ondo State, in which over 40 worshippers died

The five accused persons are Idris Abdulmalik Omeiza, Al Qasim Idris, Jamiu Abdulmalik, Abdulhaleem Idris and Momoh Otuho Abubakar.

Over 40 people were reported to have died in the attack, while over 100 others sustained injuries.

The five defendants were arraigned on a nine-count terrorism charge marked: FHC/ABJ/CR/301/2025 filed by the Department of State Services, DSS.

They are accused of being members of Al Shabab terrorist group, belonging to a cell in Kogi State.

The defendants are also alleged to have carried out the attack in furtherance of their religious ideology.

They pleaded not guilty when the charge was read to them by an official of the court.

Following their not guilty plea, prosecuting lawyer, Calistus Eze urged the court to order that the defendants be remanded in the custody of the DSS pending trial.

Defence lawyer, Abdullahi Muhammad however prayed the court to order the DSS to allow members of the defendants’ families and their lawyers to have access to them.

Muhammad said the defendants have been in custody since 2022 when they were arrested and have not had access to family members and lawyers.

Eze said it was the standard practice that detainees’ family members and lawyers should be granted access after a formal written request.

He noted that it has become inevitable at this stage that the defendants be allowed access to their lawyers to enable them prepare their defence.

Ruling, Justice Emeka Nwite ordered that the defendants be remanded in the custody of the DSS.

Justice Nwite also ordered that the DSS grant the defendants access to members of their families and their lawyers.

He then adjourned till August 19 for the commencement of trial.

Some counts in the charge read:

* That you, Idris Abdulmalik Omeiza, Al Qasim Idris, Jamiu Abdulmalik, Abdulhaleem Idris and Momoh Otuho Abubakar adults, males, with others still at large, sometime in 2021, did join and became members of AL Shabab Terrorist Group, with cell in Kogi State and thereby committed an offence contrary to and punishable under Section 25(1) of Terrorism (Prevention and Prohibition) Act, 2022.

* That you, Idris Abdulmalik Omeiza, Al Qasim Idris, Jamiu Abdulmalik, Abdulhaleem Idris and Momoh Otuho Abubakar, adults, males, with others still at large, on 30th May, 2022; 37 June, 2022 and 4 June, 2022, at Government Secondary School, Ogamirana, Adavi LGA, Kogi State and behind Omialafa Central Mosque, Ose LGA, Ondo State, respectively, attended and held meetings, where you agreed to and planned for the terrorist attack, which you carried out on 5™ June, 2022, at St. Francs Catholic Church, Owo, Ondo State and thereby committed an offence contrary to and punishable under Section 12(a) of Terrorism (Prevention and Prohibition) Act, 2022.

* That you, Idris Abdulmalik Omeiza, Al Qasim Idris, Jamiu Abdulmalik, Abdulhaleem Idris and Momoh Otuho Abubakar, adults, males, with others still at large, on 05/06/2022, at St. Francis Catholic Church, Owo, Ondo State, with intent to further your religious ideology and while armed with IEDs and AK 47 rifles, did attack worshippers, held them hostage and in the process, caused grievous bodily harm to over 100 persons, including Onileke Ayodele, John Blessing, Nselu Esther and Ogungbade Peter and thereby committed an offence contrary to Section 24 Terrorism (Prevention and Prohibition) Act, 2022 and punishable under Section 24(2)(a) of the same Act.

* That you, Idris Abdulmalik Omeiza, Al Qasim Idris, Jamiu Abdulmalik, Abdulhaleem Idris and Momoh Otuho Abubakar, adults, males, with others still at large, on 05/06/2022, had in your possession IEDs and AK 47 rifles, with which you attacked worshippers at St. Francis Catholic Church, held them hostage, killed over 40 persons and caused grievous bodily harm to over 100 persons and thereby committed an offence contrary to Section 2(1)(2) and (3)(v) and punishable under Section 24(1) and (2) of TPPA, 2022.

* That you, Idris Abdulmalik Omeiza, Al Qasim Idris, Jamiu Abdulmalik, Abdulhaleem Idris and Momoh Otuho Abubakar, adults, males, with others still at large, on 05/06/2022, at St. Francis Catholic Church, Owo, Ondo State, with intent to cause death, did detonate Improvised explosive devices (IEDs), which led to the death of over 40 persons, including: Ajanaku John; Onuoha Deborah; Onileke Esther and John Bosede and thereby committed an offence contrary to and punishable under Section 42 (a)(ii) of Terrorism (Prevention and Prohibition) Act, 2022.

* That you, Idris Abdulmalik Omeiza, Al Qasim Idris, Jamiu Abdulmalik, Abdulhaleem Idris and Momoh Otuho Abubakar, adults, males, with others still at large, on 05/06/2022, at St. Francis Catholic Church , Owo, Ondo State, with intent to cause grievous bodily harm, did detonate Improvised explosive devices (IEDs) which caused grievous bodily harm to over 100 persons, including: Onuchukwu Happiness, Ogungbade Vivan and Nnakwe Paschaline Ugochinyerem and thereby committed an offence contrary to and punishable under Section 42(a)(i) of Terrorism (Prevention and Prohibition) Act, 2022.

-

Politics10 months ago

Politics10 months agoMexico’s new president causes concern just weeks before the US elections

-

Business10 months ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

-

Trending10 months ago

Trending10 months agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

-

Entertainment10 months ago

Bobrisky falls ill in police custody, rushed to hospital

-

Entertainment10 months ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

-

Politics10 months ago

Politics10 months agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

-

Politics10 months ago

Politics10 months agoPutin invites 20 world leaders

-

Education12 months ago

GOVERNOR FUBARA APPOINTS COUNCIL MEMBERS FOR KEN SARO-WIWA POLYTECHNIC BORI