Business

FG threatens to open border for cement importation

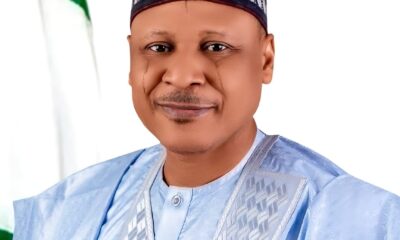

The federal government has threatened to possibly open the borders to cement importation if Nigerian cement manufacturers refuse to reduce the price of the commodity in the country.

Minister of Housing and Urban Development, Arc Ahmed Dangiwa, who made the declaration said key input materials for cement production such as limestone, clay, silica sand, and gypsum sourced within our borders, should not be dollar-rated.

Dangiwa made this known on Tuesday, February 20, in Abuja at an emergency meeting held with cement and building materials manufacturers. He said the price of gas that manufacturers are using as an excuse should not be because gas is a raw material found within the country and the excuse of an increase in mining equipment should not come up because equipment bought by these manufacturers has been used for decades and not just purchased every day.

The minister said the border was closed to the importation of cement to help local manufacturers but if the government decides to open it back for mass importation, prices of cement would crash and local manufacturers would be gravely affected.

Dangiwa who called on the manufacturers to be more patriotic said BUA cement for instance has been willing and is still willing as at the last time he spoke with them to crash the price of their cement, lower than the N7000, N8000 agreed by the manufacturers and he sees no reason why the others should not do same.

The minister in response to the manufacturers said: “The challenges you speak of, many countries are facing the same challenges and some even worse than that but as patriotic citizens, we have to rally around whenever there is a crisis to change the situation.

“The gas price you spoke of, we know that we produce gas in the country the only thing you can say is that maybe it is not enough. Even if you say about 50 percent of your production cost is spent on gas prices, we still produce gas in Nigeria it’s just that some of the manufacturers take advantage of the situation. As for the mining equipment that you mentioned, you buy equipment and it takes years and you are still using it.

“The time you bought it maybe it was at a lower price but because now the dollar is high you are using it as an excuse. Honestly, we have to sit down and look at this critically. The demand and supply should be good for you because the government stopped the importation of cement, they stopped the importation in order to empower you to produce more.

“Otherwise if the government opens the border for mass importation of cement, the price would crash but you would have no business to do and at the same time the employment generation would go down. So these are the kinds of things you have to look at, the efforts of government in ensuring things go well.”

The minister also put the blame on the Cement Manufactures of Nigeria for not regulating the price of cement in the country because earlier, the Executive Secretary of the Association, Salako James had informed the minister that the association does not discuss or determine the price of individual companies but are only made aware of prices from the market like every Nigerian.

Dangiwa said the ministry would be setting up a committee which would be comprised of representatives of each cement manufacturer in the country, its association, and the government to fashion out modalities to resolve the problem of high price of cement in the country.

Business

Soludo takes over Onitsha main market as IPOB declares compulsory sit-at-home

The Governor of Anambra State, Prof Chukwuma Soludo has announced that his government will take over the running of Onitsha Main Market.

The governor had last Monday visited the market and also announced a one week closure over the continued adherence to sit at home protest by traders in the market.

The closure had generated a lot of tension, leading to protests by the traders, while the governor stuck to his gone, insisting that the market will remain closed for one week. He also held a meeting with the leaders of the market yesterday, where he presented them with two options.

Though it was a closed door meeting, which held at the Light House, Awka, a source in the meeting told THISDAY that the traders chose to open their shops on Monday, against an earlier option of demolishing and remodelling the market.

The source said: “The governor gave them two options. The first included; they will resume full trading activities on Mondays, mark attendance as required, while he regenerate and reorganise the market, demolish all illegal structures and plazas and create proper spaces and car parks. The second includes; To continue with Sit-at-Home on Mondays and risk the demolition of the market and use two-years for its reconstruction to restore it to its original master plan.

“The governor told them that restoring parking facilities in Main Market is an emergency, and any illegal structure erected at the park would be demolished soonest.”

It was gathered that the traders choose the first option, which will involve them opening on Monday, and giving the governor the go ahead to remove illegal structures to make way for wider roads in the market and restoring its packing space.

During the meeting, the governor told the traders that a committee will be set up to rectify all occupants of shops in the market, and that this will commence work soon, insisting that the government needs to know those who are trading in its market.

The governor was also said to have rejected a plea for the market to be opened on Saturday, insisting it can only be opened on Monday, when their compliance will again be re-accessed.

“The traders agreed to the terms, and will on Monday reopen the market to recommence business,” the source said.

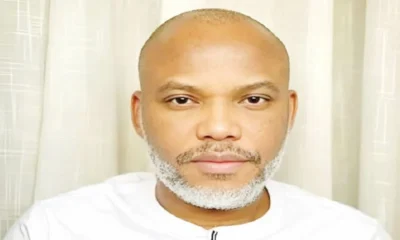

Meanwhile, secessionist group, Indigenous People of Biafra (IPOB) has declared what it called Biafra-wide solidarity lockdown which is to hold on Monday in solidarity with Onitsha traders and to demand for Mazi Nnamdi Kanu’s immediate release.

A press release by the group’s publicity secretary, Mr Emma Powerful said the total shutdown across Biafraland is a direct, peaceful, and unified response to the shutting down of Onitsha Main Market for one week by Soludo.

The release said: “We remind Governor Soludo and his Abuja sponsors that the Monday sit-at-home originated as a peaceful protest demanding the unconditional release of Mazi Nnamdi Kanu, the very cause that has galvanized global attention to Biafra’s quest for self-determination.

“Attempts to twist this into “economic sabotage” or “criminality” will fail. The markets thrived during Christmas Mondays without incident, proving that voluntary compliance stems from genuine solidarity, not fear. Soludo’s escalation only exposes his desperation to provoke confrontation at a time when Biafra’s international profile is rising and diplomatic efforts are gaining traction.

“On Monday, February 2, 2026, we call on all Biafrans traders, transporters, banks, schools, civil servants, and every sector across Anambra, Abia, Imo, Enugu, Ebonyi, and beyond to observe this solidarity strike peacefully.

“Remain indoors, refrain from all commercial and public activities, and demonstrate to the world our disciplined resolve. This is not about disruption for its own sake; it is about standing with Onitsha traders who are being punished for demanding justice, and reaffirming that no governor can coerce free citizens into abandoning their rights or their solidarity.”

Business

BUA Chairman Is My Ex-Husband – Tinubu’s Minister Opens Up On Past Secret With Abdul Samad Rabiu

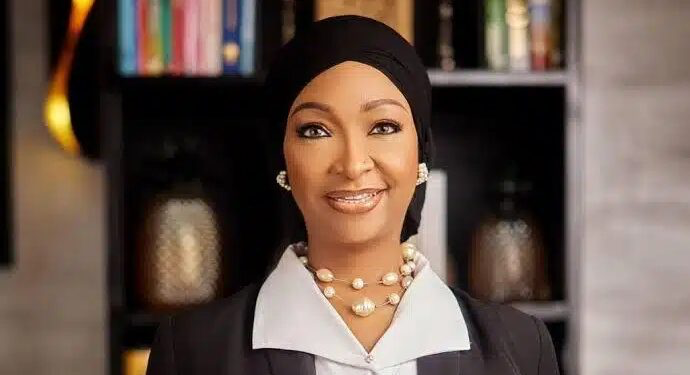

Nigeria’s Minister of Art, Culture and the Creative Economy, Hannatu Musawa has opened up about her former marriage to BUA Group chairman Abdul Samad Rabiu, describing it as a meaningful and life-shaping experience.

In a conversation on the MIC On Podcast with Channels Television journalist Seun Okinbaloye, Musawa reflected on her bond with Rabiu, saying their connection has remained strong despite their separation.

She explained that their relationship has evolved into one grounded in family ties, mutual respect, and continued support.

Musawa shared that although they are no longer married, they remain close and involved in each other’s lives.

She also pointed out the lasting connection between their families, noting that her daughter, Khadija, was named after Rabiu’s grandmother, showing the enduring link between them.

The minister described her time with Rabiu as one of the most memorable periods of her life.

She stated that there is no bitterness between them and that she will continue to support him in his endeavors, maintaining respect and care for their shared history.

She said: “We love each other because you love your family, obviously. But Samad is my brother. He’s my family. That’s what he is. And I’m his sister and his family, too. The marriage of the greatest experiences I’ve ever had.

“He is my ex-husband, but we are still family. We juggle coming from a background where, once you’re joined together, you continue to participate in each other’s lives. And so, we were married, and now we are just family.

“My daughter Khadija was named after Samad’s grandmother.

“We continue to share a deep respect and a love, and more than anything, support for each other. I’ll continue to be his greatest cheerleader.”

Abdul Samad Rabiu leads BUA Group, a Nigerian conglomerate with investments in cement, sugar, and other industries, and is regarded as one of the country’s leading business figures.

Business

LIRS reiterates January 31st deadline for employers’ Annual Tax returns filing

The Lagos State Internal Revenue Service (LIRS) has reiterated the statutory deadline of 31st January 2026 for all employers of labour in Lagos State to fulfil their statutory obligation to file their annual tax returns for the 2025 financial year.

In a statement issued on Thursday, January 19, the Executive Chairman of LIRS, Dr Ayodele Subair, reminded employers that the obligation to file annual returns is in accordance with the provisions of the Nigeria Tax Administration Act 2025 (NTAA).

Dr Subair explained that employers are required to file detailed returns on emoluments and compensation paid to their employees, as well as payments made to their service providers, vendors and consultants, and to ensure that all applicable taxes due for the year 2025 are fully remitted. He emphasised that filing of annual returns is a mandatory legal obligation, and warned that failure to comply will result in statutory sanctions, including administrative penalties, as prescribed under the new tax law.

According to Section 14 of the Nigeria Tax Administration Act 2025 (NTAA), employers are required to file detailed annual returns of all emoluments paid to employees, including taxes deducted and remitted to relevant tax authorities. Such returns must be filed and submitted not later than January 31 each year.

Dr Subair stated

“Employers must prioritise the timely filing of their annual income tax returns. Compliance should be part of our everyday business practice. Early and accurate filing not only ensures adherence to the law as required by the Nigerian Constitution, but also supports effective revenue tracking, which is important to Lagos State’s fiscal planning and sustainability.”

He further noted that in Lagos State, electronic filing via the LIRS eTax platform remains the only approved and acceptable mode of filing, as manual submissions have been completely phased out. This measure, he said, is aimed at simplifying and standardising tax administration processes in the State.

Read more in comments section

-

Business1 year ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

-

Trending1 year ago

Trending1 year agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

-

Politics1 year ago

Politics1 year agoMexico’s new president causes concern just weeks before the US elections

-

Politics1 year ago

Politics1 year agoPutin invites 20 world leaders

-

Politics1 year ago

Politics1 year agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

-

Entertainment1 year ago

Bobrisky falls ill in police custody, rushed to hospital

-

Entertainment1 year ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

-

Education1 year ago

GOVERNOR FUBARA APPOINTS COUNCIL MEMBERS FOR KEN SARO-WIWA POLYTECHNIC BORI