Business

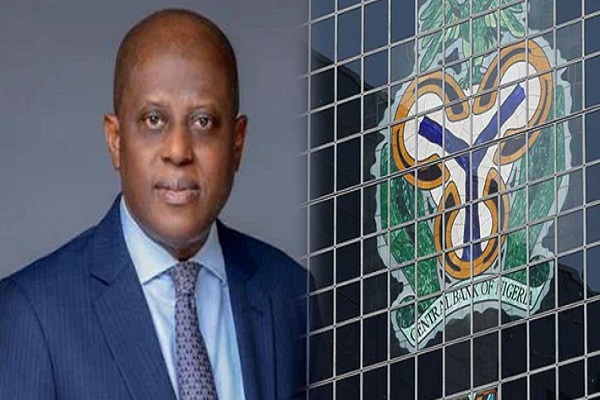

Sustaining monetary, fiscal policies for bank recapitalisation

The emergence of stronger and bigger banks is one of the crucial benefits expected from the ongoing Central Bank of Nigeria (CBN)-led recapitalisation of banks. The apex bank believes that achieving sustainable economic growth requires strong support from the financial system. The financial sector regulator is, therefore, keen on aligning monetary and fiscal policies to achieve government’s vision of growth for businesses and $1 trillion economy size for the country, writes Assistant Editor, COLLINS NWEZE.

Aligning fiscal and monetary policy objectives comes with great benefits to the economy. The Central Bank of Nigeria (CBN) is at the centre of achieving fiscal and monetary policies collaboration and supporting the government’s plan for $1 trillion economy size.

For a government that wants to grow its economy to $1 trillion mark, the support of the financial services sector led by the Central Bank of Nigeria (CBN) Governor, Olayemi Cardoso is crucial.

The CBN boss had explained that bank recapitalisation ensures that lenders are well-capitalised, enabling them to take on greater risks, particularly in underserved markets. With stronger capital bases, banks can provide more loans and financial products to Micro Small and Medium Enterprises (MSMEs), rural communities and other vulnerable segments that have previously struggled to access formal financial services.

The CBN had, on March 28, 2024 announced a two-year bank recapitalisation exercise which commenced on April 1, 2024 and is expected to end on March 31, 2026.

The recapitalisation plan requires minimum capital of N500 billion, N200 billion and N50 billion for commercial banks with international, national and regional licenses respectively.

Others included merchant banks N50 billion; non-interest banks with national license N20 billion and non-interest banks with regional license will now have N10 billion minimum capital. The 24-month timeline for compliance ends on March 31, 2026.

Cardoso said the recapitalisation policy not only strengthens financial stability but also serves as a catalyst for inclusive growth.

“By enabling banks to extend more credit to MSMEs, we enhance job creation and productivity. Furthermore, with increased capital, banks can invest in technology and innovation, crucial for driving digital financial services such as mobile money and agent banking. These technologies are important to breaking down geographic and economic barriers, bringing financial services to even the most remote areas,” he stated.

He said Nigeria has what it takes to deepen financial inclusion and support the growth of business and economy. He said the recapitalisation exercise will also support the government’s efforts to achieve a $1 trillion economy.

The CBN further underscored the importance of banking recapitalisation as a major catalyst for the achievement of the $1 trillion economy agenda of the government.

Banking sector remains robust

Cardoso explained that the banking sector remains robust, with key indicators reflecting a resilient system.

“The non-performing loan ratio remains within the prudential benchmark of five per cent, showcasing strong credit risk management. The banking sector liquidity ratio comfortably exceeds the regulatory floor of 30 per cent, a level which ensures banks are maintaining adequate cash flow to meet the needs of customers and their operations. The recent stress test conducted also reaffirmed the continued strength of our banking system,” he said.

“I am pleased to note that a significant number of banks have raised the required capital through rights issues and public offerings well ahead of the 2026 deadline. I believe that the banking sector is in a strong position to support Nigeria’s economic recovery by enabling access to credit for MSMES and supporting investment in critical sectors of our economy,” he said.

The CBN Deputy Governor, Corporate Services, Ms. Emem Usoro, said the journey to a $1 trillion economy requires structured planning, clearly defined policies, unwavering implementation, and an inclusive approach that aligns public and private sector interests.

At the just-concluded seminar organised by the CBN for business editors and financial correspondents in Abuja, Usoro said that one of the key components of the $1 trillion ambition is the recapitalisation of Nigerian banks.

She noted that banks must be sufficiently capitalised to meet the financial demands of a larger and more dynamic economy.

“As we work towards building a $1 trillion dollar economy, we must consider the recapitalisation of our banks to be able to fund, finance and power the economy, and to favourably compete globally,” Usoro said.

She further called for a collective effort from all stakeholders, adding that the financial system must be prepared to play its role in powering development.

“We should particularly pay attention to bank recapitalisation to ensure that our banks are strong, resilient and stable enough to carry out financial intermediation, and the much-needed financing of development projects and programmes,” Usoro said.

The Group Managing Director of United Bank for Africa (UBA), Mr. Oliver Alawuba described the ongoing CBN bank recapitalisation policy as both timely and essential in positioning the financial system to meet the demands of a growing and globally competitive economy.

According to Alawuba, the initiative is expected to boost the resilience of the banking sector by strengthening its capacity to withstand economic shocks such as inflation, currency volatility and global geopolitical disruptions. He noted that the policy will also place Nigerian banks on a stronger footing to finance the country’s long-term economic transformation, including funding of large-scale infrastructure and industrial projects.

Alawuba further stressed that the recapitalisation policy goes beyond regulatory compliance. It is a forward-looking strategy aimed at equipping Nigerian banks to operate at the scale and sophistication required by a trillion-dollar economy. He said the move would enhance the sector’s ability to support traditional economic drivers such as oil and gas, agriculture and manufacturing, as well as emerging sectors such as fintech, green energy and infrastructure development.

“Nigerian banks need adequate capital buffers to meet the evolving demands of these sectors. Without this, the industry cannot effectively rise to the challenge,” he said.

Alawuba further pointed out the sharp contrast between Nigerian banks and their counterparts in more advanced economies, where bank assets typically range between 70 and 150 per cent of Gross Domestic Product (GDP). In Nigeria, bank assets accounted for just 11.97 per cent of GDP as of 2024, a gap he said must be addressed if the country’s financial system is to align with international standards.

He commended the CBN’s recent directive mandating a significant increase in minimum capital thresholds, describing it as recognition of the urgent need for stronger financial institutions capable of delivering on national priorities such as infrastructure expansion, digital transformation, inclusive financial services and economic diversification.

Alawuba concluded that a robust, well-capitalised banking sector is critical for Nigeria’s aspiration to become a one trillion-dollar economy, and the recapitalisation drive is a forward-looking step to achieve that goal.

According to the Director of the Banking Supervision Department at the CBN, Olubuka Akinwunmi provided insights into the state of the banking sector by stating that banks have so far remained within the prudential thresholds stipulated by the regulator, including benchmarks for capital adequacy ratio and non-performing loans.

“Currently, all our banks are still within the prudential thresholds that were set. And they are actively pursuing various recapitalisation efforts,” Akinwunmi said.

He said priority sectors such as agriculture, infrastructure and manufacturing are receiving attention from both the government and financial institutions, as they are crucial to achieving a trillion-dollar economy.

“This year’s national budget reflects a clear emphasis on critical sectors such as health, education, infrastructure and agriculture. Banks are taking cues from these priorities, recognising them as viable areas for business expansion,” Akinwunmi said.

On how many internationally-active banks had met the new N500 billion capital requirement, he noted that substantial progress has already been made.

“We are halfway through the journey in terms of timeline, and in terms of capital already raised; we are also halfway through. That is a positive signal,” he said.

He added that the decision to start the recapitalisation process early has helped insulate the financial system from emerging global and domestic shocks.

“The emerging global economic shifts and pressures were not lost on the management of the CBN. We started early. If we had waited till now, the challenges would have been greater. But we acted in time,” he stated.

Dr Akinwunmi expressed his confidence that the recapitalisation requirements will be met, stressing that existing shareholders’ funds continue to serve as a buffer. However, the CBN deliberately opted for fresh capital inflows, particularly from foreign investors who have shown renewed confidence in Nigeria’s financial system.

“International perception of Nigeria’s banking sector is improving. The reforms over the past year, especially around the foreign exchange regime and improved transparency regarding reserves, have improved investors’ confidence,” he said.

He cited recent disclosures on Nigeria’s net reserves and improvements in regulatory credibility as key factors that are reshaping the outlook for foreign direct investment in the banking sector.

On the Loan to Deposit Ratio (LDR), Akinwunmi explained that the current 50 per cent benchmark does not reflect a reluctance to lend but rather a contextual response to inflation and other macroeconomic challenges.

“As the macro-economic environment stabilises, banks will naturally increase lending. It’s a cautious approach to ensure that lending supports sustainable growth,” he said.

He also touched on the Cash Reserve Ratio (CRR), stating that there has been marked improvement in transparency. Banks now have a clearer understanding of CRR computations, unlike in the past, which enhances predictability and compliance.

On Small and Medium Enterprises (SME) funding, he confirmed that banks have continued to make provisions, but the CBN remains actively engaged to ensure proper disbursement and sectorial targeting. Supervisory oversight, he explained, is being deployed to verify compliance and effectiveness of disbursed funds.

On incentives, he said the most powerful incentive for banks lay in the opportunities provided by a growing economy.

“A stronger bank can take on big-ticket businesses, including infrastructure financing. The current reforms, such as the infrastructure concession plans, present viable business opportunities for well-capitalised banks,” Akinwunmi said.

The capital verification process, according to him, is thorough and designed to ensure that only legitimate, unborrowed funds are used for recapitalisation. An industry-wide tracking mechanism has been established to streamline verification across institutions and enhance collaboration.

“Our examiners follow each capital trail meticulously, moving from one bank to another as necessary. Even if it’s not your bank under verification at that moment, we expect full cooperation to trace the sources of capital,” he said.

On the broader question of resilience to global shocks, he maintained that Nigerian banks are being positioned to remain attractive to investors and capable of withstanding external disruptions.

“CBN is monitoring developments closely and adjusting where necessary. The recapitalisation process is not just about compliance — it’s about long-term stability, competitiveness and economic transformation,” he said.

Business

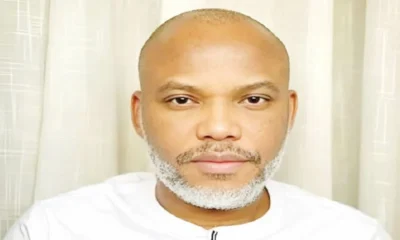

Soludo takes over Onitsha main market as IPOB declares compulsory sit-at-home

The Governor of Anambra State, Prof Chukwuma Soludo has announced that his government will take over the running of Onitsha Main Market.

The governor had last Monday visited the market and also announced a one week closure over the continued adherence to sit at home protest by traders in the market.

The closure had generated a lot of tension, leading to protests by the traders, while the governor stuck to his gone, insisting that the market will remain closed for one week. He also held a meeting with the leaders of the market yesterday, where he presented them with two options.

Though it was a closed door meeting, which held at the Light House, Awka, a source in the meeting told THISDAY that the traders chose to open their shops on Monday, against an earlier option of demolishing and remodelling the market.

The source said: “The governor gave them two options. The first included; they will resume full trading activities on Mondays, mark attendance as required, while he regenerate and reorganise the market, demolish all illegal structures and plazas and create proper spaces and car parks. The second includes; To continue with Sit-at-Home on Mondays and risk the demolition of the market and use two-years for its reconstruction to restore it to its original master plan.

“The governor told them that restoring parking facilities in Main Market is an emergency, and any illegal structure erected at the park would be demolished soonest.”

It was gathered that the traders choose the first option, which will involve them opening on Monday, and giving the governor the go ahead to remove illegal structures to make way for wider roads in the market and restoring its packing space.

During the meeting, the governor told the traders that a committee will be set up to rectify all occupants of shops in the market, and that this will commence work soon, insisting that the government needs to know those who are trading in its market.

The governor was also said to have rejected a plea for the market to be opened on Saturday, insisting it can only be opened on Monday, when their compliance will again be re-accessed.

“The traders agreed to the terms, and will on Monday reopen the market to recommence business,” the source said.

Meanwhile, secessionist group, Indigenous People of Biafra (IPOB) has declared what it called Biafra-wide solidarity lockdown which is to hold on Monday in solidarity with Onitsha traders and to demand for Mazi Nnamdi Kanu’s immediate release.

A press release by the group’s publicity secretary, Mr Emma Powerful said the total shutdown across Biafraland is a direct, peaceful, and unified response to the shutting down of Onitsha Main Market for one week by Soludo.

The release said: “We remind Governor Soludo and his Abuja sponsors that the Monday sit-at-home originated as a peaceful protest demanding the unconditional release of Mazi Nnamdi Kanu, the very cause that has galvanized global attention to Biafra’s quest for self-determination.

“Attempts to twist this into “economic sabotage” or “criminality” will fail. The markets thrived during Christmas Mondays without incident, proving that voluntary compliance stems from genuine solidarity, not fear. Soludo’s escalation only exposes his desperation to provoke confrontation at a time when Biafra’s international profile is rising and diplomatic efforts are gaining traction.

“On Monday, February 2, 2026, we call on all Biafrans traders, transporters, banks, schools, civil servants, and every sector across Anambra, Abia, Imo, Enugu, Ebonyi, and beyond to observe this solidarity strike peacefully.

“Remain indoors, refrain from all commercial and public activities, and demonstrate to the world our disciplined resolve. This is not about disruption for its own sake; it is about standing with Onitsha traders who are being punished for demanding justice, and reaffirming that no governor can coerce free citizens into abandoning their rights or their solidarity.”

Business

BUA Chairman Is My Ex-Husband – Tinubu’s Minister Opens Up On Past Secret With Abdul Samad Rabiu

Nigeria’s Minister of Art, Culture and the Creative Economy, Hannatu Musawa has opened up about her former marriage to BUA Group chairman Abdul Samad Rabiu, describing it as a meaningful and life-shaping experience.

In a conversation on the MIC On Podcast with Channels Television journalist Seun Okinbaloye, Musawa reflected on her bond with Rabiu, saying their connection has remained strong despite their separation.

She explained that their relationship has evolved into one grounded in family ties, mutual respect, and continued support.

Musawa shared that although they are no longer married, they remain close and involved in each other’s lives.

She also pointed out the lasting connection between their families, noting that her daughter, Khadija, was named after Rabiu’s grandmother, showing the enduring link between them.

The minister described her time with Rabiu as one of the most memorable periods of her life.

She stated that there is no bitterness between them and that she will continue to support him in his endeavors, maintaining respect and care for their shared history.

She said: “We love each other because you love your family, obviously. But Samad is my brother. He’s my family. That’s what he is. And I’m his sister and his family, too. The marriage of the greatest experiences I’ve ever had.

“He is my ex-husband, but we are still family. We juggle coming from a background where, once you’re joined together, you continue to participate in each other’s lives. And so, we were married, and now we are just family.

“My daughter Khadija was named after Samad’s grandmother.

“We continue to share a deep respect and a love, and more than anything, support for each other. I’ll continue to be his greatest cheerleader.”

Abdul Samad Rabiu leads BUA Group, a Nigerian conglomerate with investments in cement, sugar, and other industries, and is regarded as one of the country’s leading business figures.

Business

LIRS reiterates January 31st deadline for employers’ Annual Tax returns filing

The Lagos State Internal Revenue Service (LIRS) has reiterated the statutory deadline of 31st January 2026 for all employers of labour in Lagos State to fulfil their statutory obligation to file their annual tax returns for the 2025 financial year.

In a statement issued on Thursday, January 19, the Executive Chairman of LIRS, Dr Ayodele Subair, reminded employers that the obligation to file annual returns is in accordance with the provisions of the Nigeria Tax Administration Act 2025 (NTAA).

Dr Subair explained that employers are required to file detailed returns on emoluments and compensation paid to their employees, as well as payments made to their service providers, vendors and consultants, and to ensure that all applicable taxes due for the year 2025 are fully remitted. He emphasised that filing of annual returns is a mandatory legal obligation, and warned that failure to comply will result in statutory sanctions, including administrative penalties, as prescribed under the new tax law.

According to Section 14 of the Nigeria Tax Administration Act 2025 (NTAA), employers are required to file detailed annual returns of all emoluments paid to employees, including taxes deducted and remitted to relevant tax authorities. Such returns must be filed and submitted not later than January 31 each year.

Dr Subair stated

“Employers must prioritise the timely filing of their annual income tax returns. Compliance should be part of our everyday business practice. Early and accurate filing not only ensures adherence to the law as required by the Nigerian Constitution, but also supports effective revenue tracking, which is important to Lagos State’s fiscal planning and sustainability.”

He further noted that in Lagos State, electronic filing via the LIRS eTax platform remains the only approved and acceptable mode of filing, as manual submissions have been completely phased out. This measure, he said, is aimed at simplifying and standardising tax administration processes in the State.

Read more in comments section

-

Business1 year ago

US court acquits Air Peace boss, slams Mayfield $4000 fine

-

Trending1 year ago

Trending1 year agoNYA demands release of ‘abducted’ Imo chairman, preaches good governance

-

Politics1 year ago

Politics1 year agoMexico’s new president causes concern just weeks before the US elections

-

Politics1 year ago

Politics1 year agoPutin invites 20 world leaders

-

Politics1 year ago

Politics1 year agoRussia bans imports of agro-products from Kazakhstan after refusal to join BRICS

-

Entertainment1 year ago

Bobrisky falls ill in police custody, rushed to hospital

-

Entertainment1 year ago

Bobrisky transferred from Immigration to FCID, spends night behind bars

-

Education1 year ago

GOVERNOR FUBARA APPOINTS COUNCIL MEMBERS FOR KEN SARO-WIWA POLYTECHNIC BORI